1. How does a household budget in Excel work? 📊

A classic Excel budget typically has three components: income, expenses, and categories. For each transaction, you enter the date, amount, description, and appropriate category. Excel then adds everything up and presents the information in tables or charts.

It works well, especially if you enjoy building things yourself. However, precision is essential, one small error and your entire overview can be inaccurate.

2. When does Excel work well? ✍️

A household budget in Excel works best if:

- You have relatively few transactions each month

- You enjoy working with tables and formulas

- You don’t mind updating everything manually

As soon as life gets busy, you manage multiple accounts, or you simply don’t feel like handling everything yourself, Excel quickly becomes too labour-intensive.

3. Where does an Excel household budget often go wrong? ⚠️

There are several common reasons why people abandon their Excel budgets:

- Manual entry takes time. Every debit card payment, subscription, online purchase, or automatic deduction must be entered by hand. It becomes a daily chore.

- Categories remain messy. Bank transaction descriptions are often cryptic, making it difficult to stay organised without constant maintenance.

- Mistakes slip in easily. A typo, incorrect formula, or missed row can skew your entire overview and Excel won't necessarily warn you.

- You lack insight at the moment you need it. Your spreadsheet typically lives on your laptop not in the supermarket, not on the go, and not during impulse purchases. As a result, you check it less frequently than you should.

4. What’s the alternative? 🔄

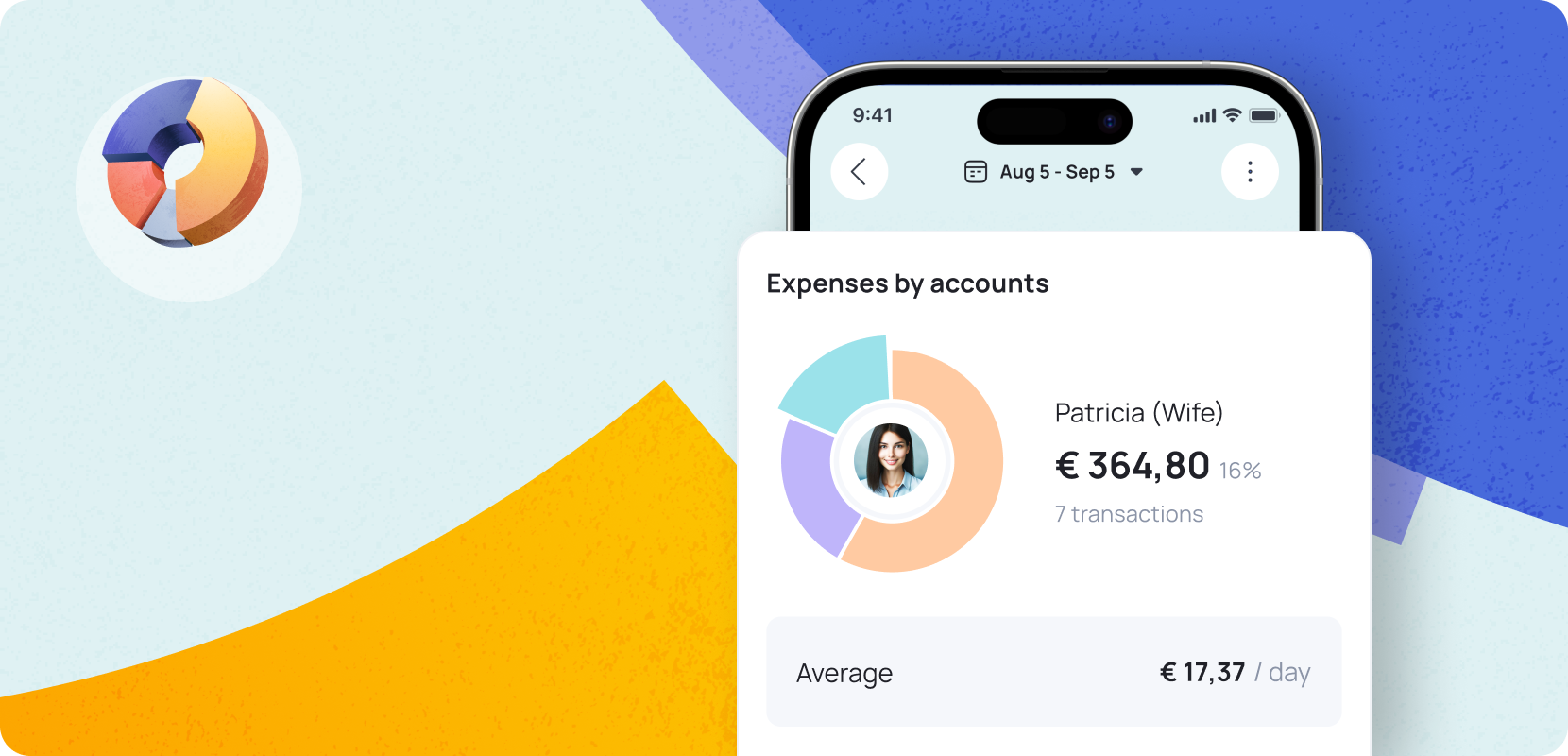

Managing your finances can be significantly easier. Grassfeld takes most of the manual work out of your hands:

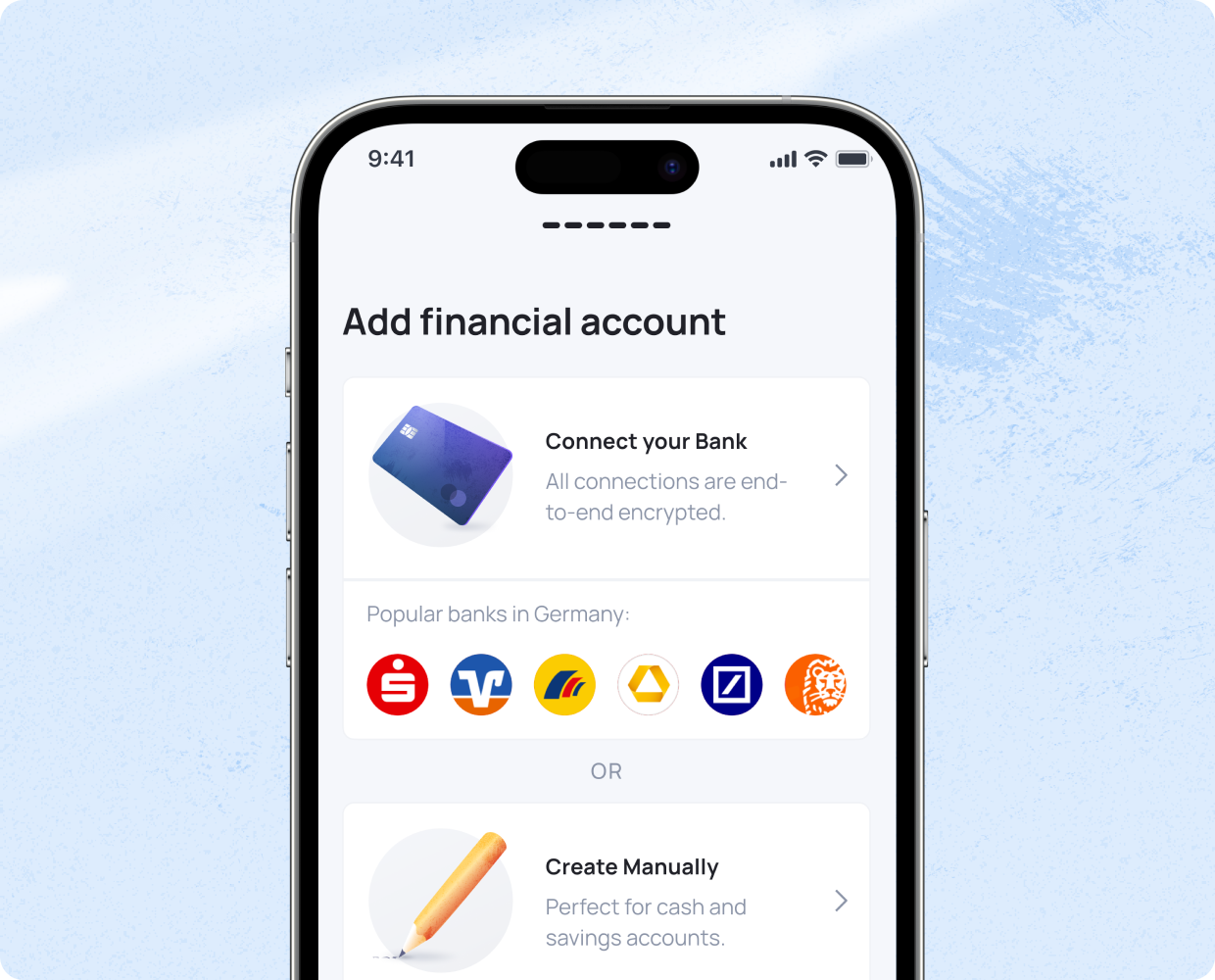

- You link your bank account, so all transactions appear automatically.

- The app categorises most expenses for you.

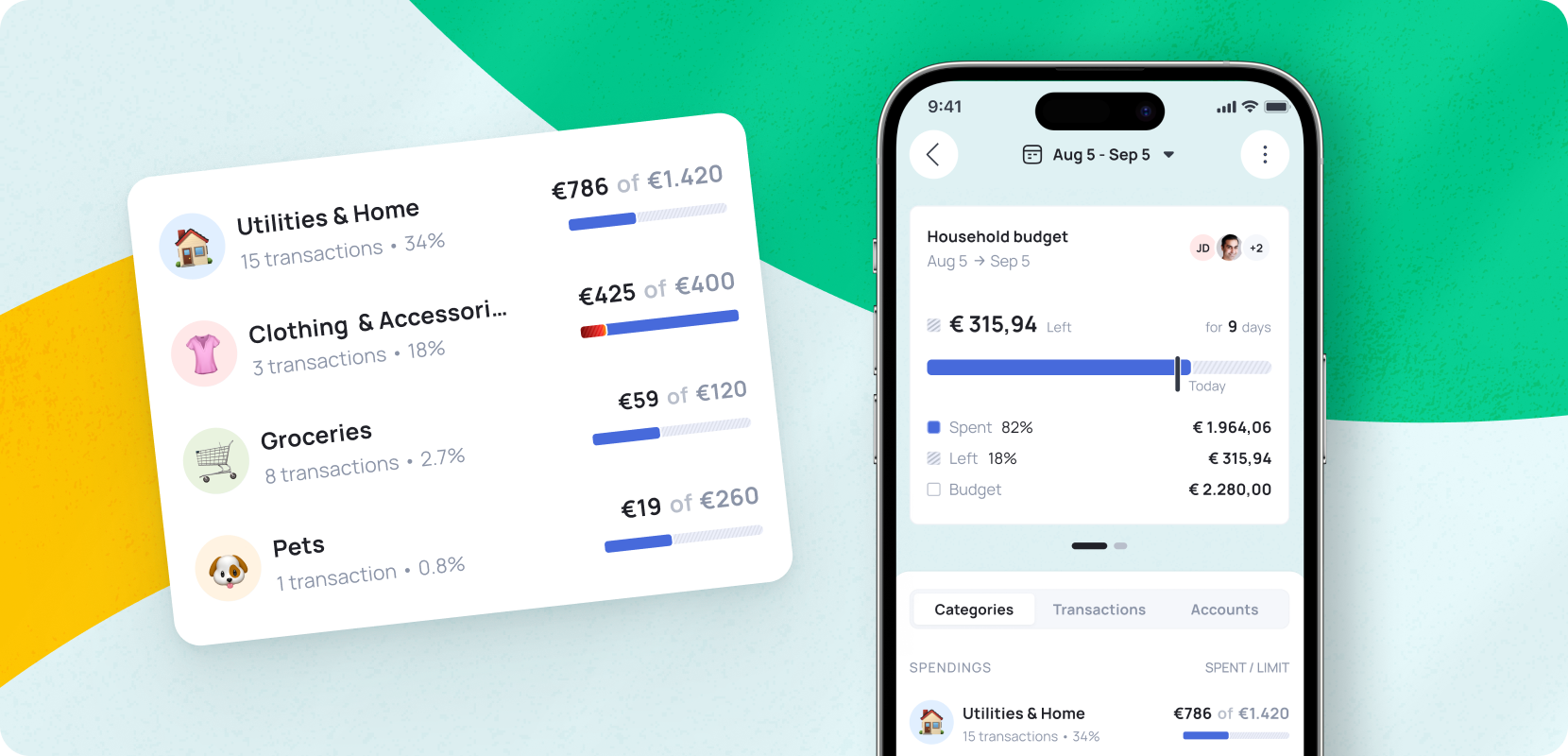

- Your budgets are automatically matched with your transactions, so you always know how much room you have left per category.

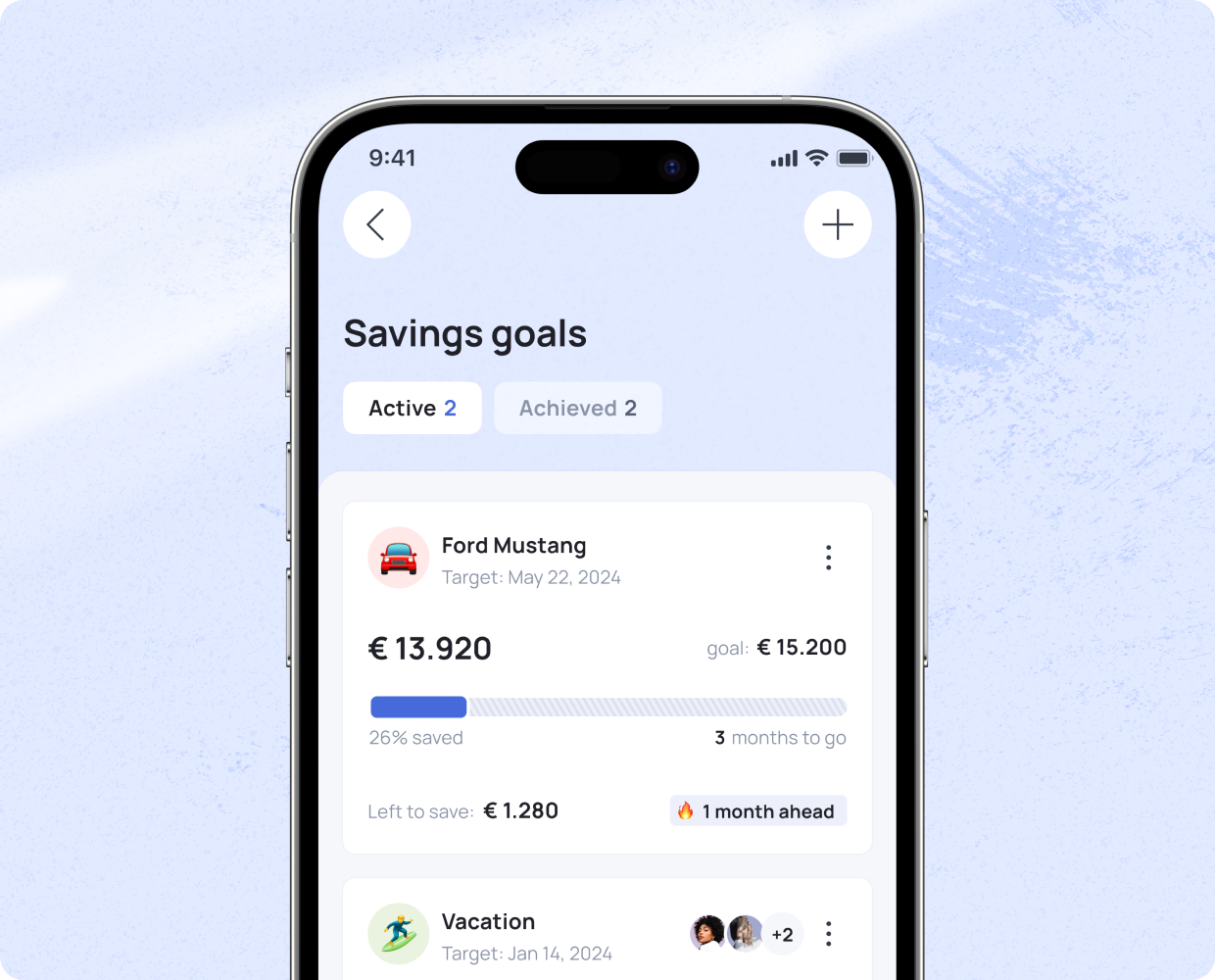

- Your savings goals are visible in one overview — no formulas or extra tabs required.

This gives you faster and clearer insights into your finances than an Excel household budget ever could.

5. Why switch? ✨

Excel offers freedom — but also a lot of extra work. Grassfeld provides clarity without the hassle. For many, this feels like a significant relief. You no longer need to calculate how much you’ve spent on groceries or subscriptions in a given month — the app shows it to you automatically, every day.

You also gain precise insights into where your money goes, enabling you to make smarter financial choices more quickly.

If you want to maintain a household budget without the daily administrative work, the Grassfeld app takes care of most of it. You simply link your bank account, set your budgets, and the app does the rest. That gives you more time for the things you truly enjoy, while still maintaining a clear overview of your finances every day.

Download Grassfeld app

Download the free Grassfeld app from your app store and experience the convenience for yourself.